Washington State Sales Tax For Shopp Wordpress Plugin - Rating, Reviews, Demo & Download

Plugin Description

Washington State is a destination-based sales tax state. As a Washington-based business, if you sell taxable items within WA, you charge the tax rate of the destination you’re shipping to, rather than the rate of where you’re shipping from.

When selling digital goods, the billing address is use to calculate tax.

Most e-commerce platforms have relatively rudimentary tax calculation tools and tables. Shopp, while robust, doesn’t have the ability to calculate the actual sales tax in Washington State based on destination address and zip.

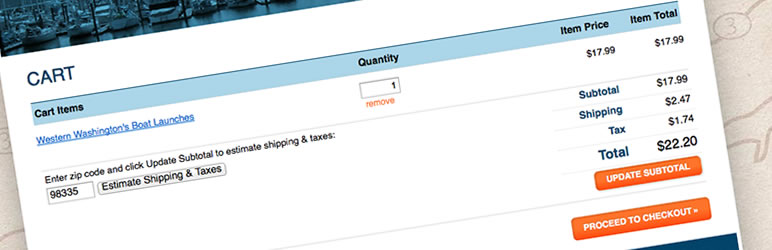

When enabled, the customer’s zip and address information is passed up to the WA DOR along with some basic information about the order and it returns the actual tax rate, and amount for the ship-to address.

Find out more about Washington’s Destination-based Sales Tax