WooCommerce EU VAT Assistant Wordpress Plugin - Rating, Reviews, Demo & Download

Plugin Description

Important

The EU VAT Assistant reached its end of life on the 30th of June 2022 (see the announcement from January 2022). The plugin is still functional and it can be used, but it’s no longer maintained or supported. We’re keeping it available for a while longer as a courtesy to existing users who have developers who can take care of its maintenance and troubleshooting.

For more information about the plugin retirement and the recomemnded alternative, please refer to the sticky post in the support forum: EU VAT Assistant – End of life and recommended alternative.

This is a full version of the premium EU VAT Assistant plugin

We are proud to say that this is the most powerful free EU VAT solution on the market. It was designed with you, the merchant, in mind, and it will make it easier to deal with the new, complex EU VAT regulations. this plugin was developed by Aelia Team – The WooCommerce internationalisation experts.

The WooCommerce EU VAT Assistant is designed to help achieving compliance with the new European VAT regulations, coming into effect on the 1st of January 2015. Starting from that date, digital goods sold to consumers in the European Union are liable to EU VAT, no matter where the seller is located. The VAT rate to apply to each sale is the one charged in the country of consumption, i.e. where the customer resides. These new rules apply to worldwide sellers, whether resident in the European Union or not, who sell their products to EU customers. For more information: EU: 2015 Place of Supply Changes – Mini One-Stop-Shop.

How this plugin will help you

The EU VAT Assistant plugin extends the standard WooCommerce sale process and calculates the VAT due under the new regime. The information gathered by the plugin can then be used to prepare VAT reports, which will help filing the necessary VAT/MOSS returns.

- Tracks and records customers’ location. The EU VAT Assistant plugin also records details about each sale, to prove that the correct VAT rate was applied. This is done to comply with the new rules, which require that at least two pieces of non contradictory evidence must be gathered, for each sale, as a proof of customer’s location. The evidence is saved automatically against each new order, from the moment the EU VAT compliance plugin is activated.

- Collects evidence required by the new regulations. All the data used to determine the VAT regime to apply is recorded in real-time, stored with the order and made available as needed.

- Accepts and validates EU VAT numbers, adjusting VAT accordingly. Validation of European VAT numbers is performed via the official VIES service, provided by the European Commission. This feature is equivalent to the one provided by the EU VAT Number plugin.

- Supports a dedicated VAT currency, which is used to generate the reports. You can sell in any currency you like, the EU VAT Assistant plugin will take care of converting the VAT amounts to the currency you will use to file your returns.

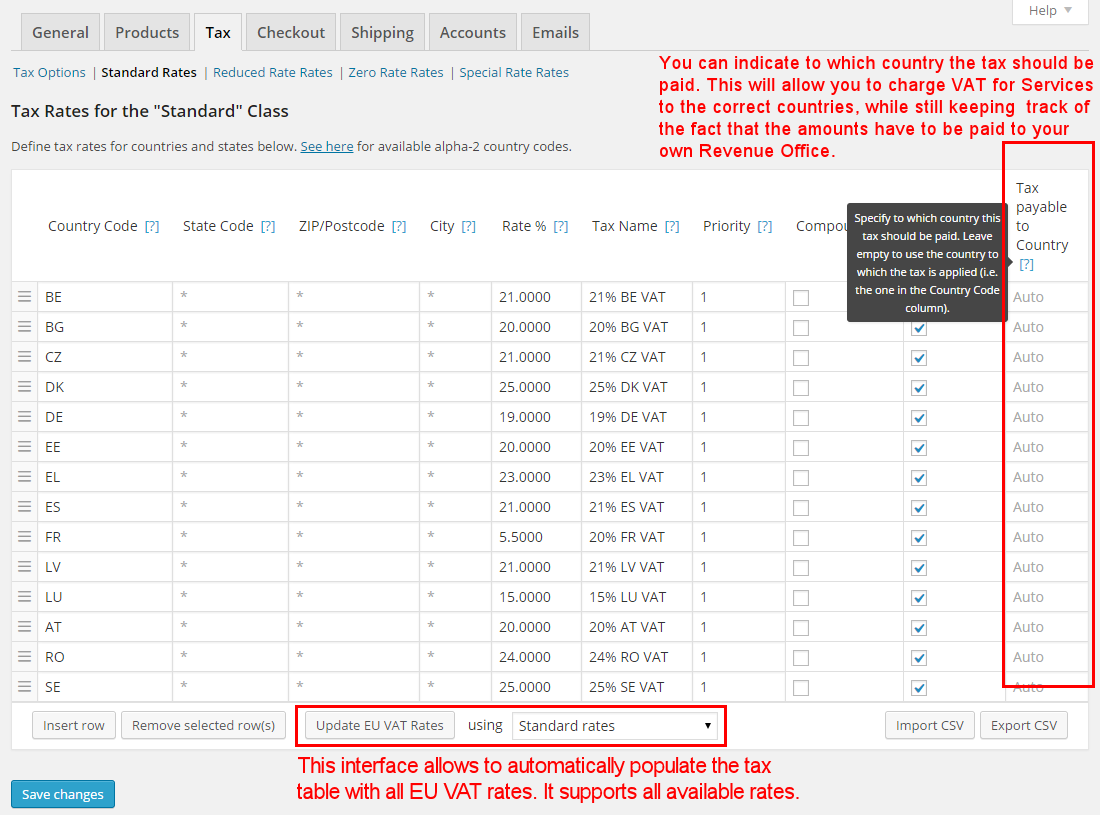

- Can automatically populates the VAT rates for all EU countries. With a single click, you enter the VAT rates for all 28 EU countries. No more tedious manual typing!

- Includes advanced Reports

- EU VAT report by Country. This report will show you all the VAT collected under the VAT MOSS regime, as well as the VAT collected for your domestic VAT return.

- VIES report. This report shows all the supplies provided to B2B customers.

- INTRASTAT report. This report shows all the sales made to the EU.

- Sales by Country (in development).

- Supports ECB exchange rates in VAT MOSS reports. VAT MOSS Reports can use either the exchange rate saved with each order, or the European Central Bank rate required to produce the official VAT MOSS returns (ref. official documentation). This feature will allow you to use the most appropriate rate when producing your domestic VAT return and the VAT MOSS return.

- Supports mixed products/services scenarios. The new EU VAT MOSS regime applies to the sale of digital products and services that do not require significal manual intervention. Sale of services that are provided with human intervention, such as support, consultancy, design, are still subject to VAT at source. In this case, VAT has to be paid to the revenue in merchant’s country. WooCommerce allows to specify to which country a tax applies, but not to which country it should be paid once collected. The EU VAT Assistant can help, by allowing merchants to specify the “payable to” country for each VAT. Such information is then displayed in the VAT reports.

- Allows to force B2B or B2C sales. You can decide if you wish to force customers to a valid EU VAT number at checkout, thus accepting only B2B transactions, or prevent them from doing it, thus accepting only B2C transactions.

- Can prevent sales to specific countries. You can exclude some countries from the list of allowed ones, thus preventing customers from those countries from placing an order.

- It’s fully compatible with our internationalisation solutions, such the WooCommerce Currency Switcher, for multi-currency support, Prices by Country, Tax Display by Country and Prices by Role (coming soon).

- Automatically updates the exchange rates that are be used to produce the VAT reports in the selected VAT currency. The plugin can fetch exchange rates from the following providers:

- European Central Bank

- HM Revenue and Customs service

- Bitpay

- Irish Revenue (experimental)

- Danish National Bank (sponsored by Asbjoern Andersen).

- Fully supports refunds. Refunds were introduced in WooCommerce 2.2, and support for it was added to our plugin right from the start.

- Integrates with PDF Invoices and Packing Slips plugin, to automatically generate EU VAT-compliant invoices.

Requirements

- WordPress 4.0 or newer.

- PHP 7.1 or newer.

- WooCommerce 3.5 or newer.

- Aelia Foundation Classes framework 2.1.0.201112 or newer.

Disclaimer

This product has been designed to help you fulfil the requirements of the following new EU VAT regulations:

- Identify customers’ location.

- Collect at least two non-contradictory pieces of evidence about the determined location.

- Apply the correct VAT rate.

- Ensure that VAT numbers used for B2B transactions are valid before applying VAT exemption.

- Collect all the data required to prepare VAT returns.

We cannot, however, give any legal guarantee that the features provided by this product will be sufficient for you to be fully compliant. By using this product, you declare that you understand and agree that we cannot take any responsibility for errors, omissions or any non-compliance arising from the use of this plugin, alone or together with other products, plugins, themes, extensions or services. It will be your responsibility to check the data produced by this product and file accurate VAT returns on time with your Revenue authority. For more information, please refer to our terms and conditions of sale and support.

Screenshots

Settings > Checkout. In this section you can configure how the EU VAT Assistant will behave on the checkout page.

Settings > Self-certification. In this section you can configure if the plugin should allow customers to self-certify their location.

Settings > Currency. In this section you can specify which currency you would like to use for VAT reports. It doesn’t have to match the WooCommerce base currency. In the lower section, you can choose which provider you would like to use to retrieve the exchange rates that will be used to calculate the amounts in VAT currency.

Settings > Sales. This section contains the settings that can be used to control how sales are handled (e.g. by preventing sales to some specific countries).

Settings > Options. Miscellaneous options.

Settings > Shortcuts. This section contains a few handy shortcuts to reach the WooCommerce sections related to the EU VAT compliance.

Frontend > Checkout. This screenshot shows the new elements displayed to the customer at checkout. The EU VAT Number field can be used by EU businesses to enter their own VAT number. The number is validated using the VIES service and, when valid, a VAT exemption is applied automatically. The self-certification element can be used to allow the customer to self-certify that he is resident in the country he selected. This information can be used as a further piece of evidence to prove that the correct VAT rate was applied.

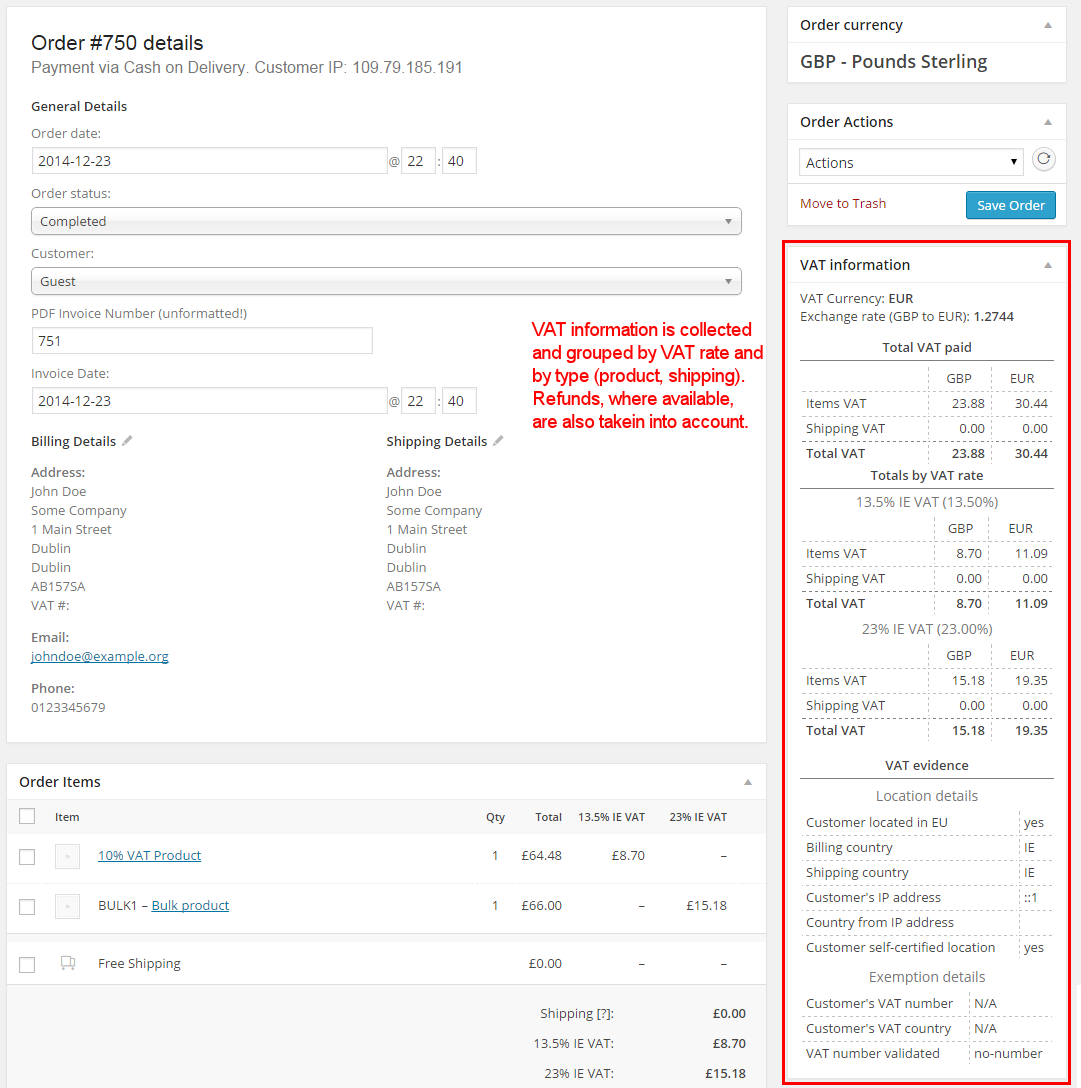

Admin > WooCommerce > Order edit page. This page shows how the VAT details are displayed when an order is reviewed in the Admin section. The meta box shows the details of the VAT charged for order items and shipping, as well as the amounts refunded. Note: refunds are available in WooCommerce 2.2 and later.

Admin > WooCommerce > Tax Settings. This screenshots shows the Tax Settings page extended by the EU VAT Assistant. The new user inerface allows to automatically retrieve and update the European VAT rates. It’s possible to choose which VAT rates are applied in each page. Another important feature is the possibility to specify to which country a VAT will have to be paid. It will be possible, for example, to apply a 20% UK VAT for services to a German customer who buys consultancy hours, and still keep track of the fact that such tax will have to be paid to HMRC (i.e. outside of MOSS scheme).

Report > EU VAT by Country. This report shows the totals of VAT applied and refunded at each rate, for both items and shipping, grouped by country. The Export CSV button allows to export the data to a CSV file, which can be easily imported by accounting software.